Free expense tracker printable to understand where your money is going and to help you stay within your budget and save money.

I find that my daily spending can get out of hand when I don’t use an expense tracker. I don’t always know where I stand, and at the end of the month, I don’t understand how I spent as much as I did.

When you use an expense tracker, you not only track expenses and keep track of your budget, but you are more conscious about what you spend since you are keeping a record.

Monthly Expense Tracker Printable

The following expense trackers track your expenses only. If you want to track both expenses and income, then see our monthly budget template.

Once you have listed each expense in the table, mark it as either “need” or “want”.

If an expense has been marked as “want”, then you can make three choices:

- Keep that expense (assuming you can afford it).

- Eliminate that expense.

- Find a cheaper or free alternative (for example, you might stop eating out and eat at home or stop ordering lattes and drink coffee at home or work instead).

Once you have gone through each expense and decided what you will eliminate or reduce, adjust the subtotal, and work out your total expenses.

Compare your expenses to your income and see if you need to be more ruthless in determining which expenses to eliminate or reduce.

Don’t forget to include savings in your expenses. See the section on “How much should you save?”

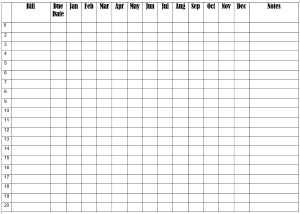

Bill Tracker Template

Yearly Bill Tracker

This is a yearly bill payment calendar that you can print blank or with any border.

A bill tracker paper planner is often more useful than a spreadsheet. You can keep it in your bag and take it out each time you spend money. When you use a spreadsheet that isn’t accessible, you might find yourself forgetting to update it each time you spend.

Bill Pay Checklist

This bill payment tracker is similar to the one above, but it has fewer fields (bill description, amount, and due date). It also has a checkbox for each month to mark when the bill is paid.

The advantage of a bill tracker printable such as this one is that it can be stored somewhere accessible. You can then mark off each bill as it is paid to ensure that it is constantly up to date. An Excel track Excel format is more convenient to calculate the totals, but you are less likely to update it in real-time.

Monthly Bill Tracker

This monthly bill tracker template will keep a list of your monthly bills, how much each bill is, and whether or not it was paid. One thing I love about a monthly bills checklist is marking a bill when it’s paid. The satisfaction is similar to marking something off your to-do list.

Bill Calendar Template

Yearly Bill Calendar

Monthly Bill Calendar

This is a monthly calendar with one page per month. This is useful if you want to mark payments and expenses on a calendar and then move them to a free printable monthly bill payment log when you have more time. This ensures that you don’t forget to track expenses and bills when you don’t have time to log them into an organized spreadsheet.

2023 – Word – Typeable PDF

Expense Tracker Excel

This is a personal expense tracker Excel template. Use it to track your monthly expenses. If you want to track both expenses and income with an Excel spreadsheet, then see our monthly budget template.

Excel Version | PDF | Monthly Budget Spreadsheet with Savings Goal

Monthly expense Excel template.

Expense Tracker Printable

Select a free printable expense tracker template from the selection below. Each template is customizable and editable. These templates are perfect if you are trying to stick to a specific design theme since there are 101 different borders available and you can control the color of the expense tables.

Daily Spending Tracker

This printable expense sheet is totally customizable. You can choose the expenses tracker and you can also select any border (there are hundreds available). You can also change the color of the tables and you can edit the text.

Bullet Journal Expense Tracker

Many people use their bullet journal to track their spending. When you write down what you spend, you tend to waste less. Also, when you use a bill organizer template, you know where you stand when it comes to your bills and expenses. This prevents you from reaching a situation where you can’t cover your monthly bills or are not left with enough money to save.

Please note that the text is editable so you can change the titles. If you don’t want your title to read “Spending Tracker” then feel free to change it.

Why should you track your expenses?

There are two basic approaches to budgeting: the cash system or tracking your expenses. Different people will prefer different approaches.

- With the cash system, you switch as many financial transactions as possible to cash. As soon as you start paying with cash instead of plastic, you will spend less. You will also save credit card charges, interest payments, and your monthly credit card bill. To make the transition to cash only, see the cash envelope system. Divide your monthly budget into weekly installments or create cash envelopes for each expense. Always try to keep a buffer on the side just in case you receive a bill you’d forgotten about.

- Tracking your expenses is another popular budgeting system. The idea here is to record every single transaction in a budget sheet with columns for the date, the item purchased, and the total cost. We offer many budget templates that will help you track your expenses. When you record every dollar spent, you will be able to find previously hidden patterns. For example, when you see how much you spent on coffee at Starbucks every month, you might decide to make coffee at home and take it with you in a reusable thermal coffee cup. It is difficult to find these patterns when you don’t track each expense.

How to Keep an Expense Log

Once you have printed an expense log template what do you do with it?

Record each item

The best way to keep track of your expenses is to record each item in real-time (i.e. as you spend on something). This will prevent you from forgetting to add small items that add up. Alternatively, you can also schedule a few minutes each day to record your spending. However, you might find that you forget to add expenses if you don’t write them as they occur. If you don’t have time to track your expenses as they incur then save the receipts or invoices and add them to your expense chart when you have the time. If you save the receipts, it will increase your chances of remembering each expense.

If you have more than one spender in your household then make sure that everyone is in the picture and tracking expenses.

Add monthly bills that repeat themselves each month in advance and update if necessary.

You might want to set daily reminders to record your expenses.

Categorize your expenses

This enables you to get a better picture of how much you spend in each category. Some of the printable trackers divide expenses into categories. Since the template is editable, feel free to change the categories if your needs are different. People generally categorize expenses into the following categories: housing (mortgage or rent), food (groceries and eating out), utilities, auto and transportation, travel, health, school or education, children, clothing, pets, entertainment, savings, gifts, and giving, miscellaneous, etc. You can, of course, change the categories according to your needs.

Another way to divide your expenses is to distinguish between necessities and things you want. The 50 30 20 rule divides your take-home income into three categories: needs (50%), wants (30%), and savings and debt repayment (20%).

If you live in a major city then this might sound unrealistic. Your rent alone might claim half your salary even before you start paying for utilities, food, etc. That doesn’t mean that the 50-30-20 system isn’t useful for you. It just means you need to think of these percentages as a goal for when you earn enough for them to be realistic. Right now, you can adjust them to your specific situation. However, as soon as you earn more, you can work your way slowly toward the ideal and better align your percentages.

If you run your own business, then you will need to distinguish between business expenses and personal expenses.

Distinguish between expenses you need or want

When you distinguish between expenses that you need or want, it will help you understand if you really need to spend something or just want to in which case you might decide to cut back if you need to budget. It is so much easier to avoid getting into debt than to get out of debt. Distinguishing between what you need or want will help you determine where you can cut back.

Make a savings goal

Many experts state that you should save at least 20% of your income (after taxes). To know how much you can save you need to know how much you have left each month assuming you don’t waste money. See our savings tracker printable.

Set a Monthly Budget

Use the Excel budget template or create a budget chart with any of the other printables. Go over your credit card statement, bank statements from all bank accounts, bills, etc, to ensure that all your monthly expenses are included. The budget spreadsheet provided divides expenses into categories which helps ensure you don’t forget to include items in your budget. If you have expenses that are paid annually, include an average sum per month to ensure that your monthly and yearly budget template will be similar and that both are accurate. Once you have included all monthly expenses you will know how much you should be spending. This is a good stage to create a savings goal. Once you know how much you should be spending you can ensure your expense log is aligned and you don’t spend more than you should. A good way to ensure you reach your savings goal is to put that money aside at the beginning of each month before you start spending. That way, if you don’t have enough money you will have to spend less instead of saving less.

How Can you Reduce Expenses?

Once you have recorded all expenses in your spending tracker printable you will find it easier to determine how and where you can save. Most people are unsure about how to not spend money on things they don’t really need because they have never given much thought to what they need and what they want.

- Sometimes, you spend less just by tracking your expenses. Similar to a food log that sometimes stops mindless eating when you know you will have to track what you ate. Expense management causes you to actually give thought to what you spend and where your money is going.

- Some of the printable trackers have a section to distinguish between expenses you want or need. This makes you think if you actually need something. Items in the “want” category are clearly the first ones that you will think twice about buying.

- Try to find cheaper places to purchase items or services that you need. Sometimes, if you spend some time researching you might find a cheaper place. This will enable you to spend less without cutting back.

- Can you make some of the things that you buy? If you spend a lot on store-bought coffee or take-outs this is an easy way to save. Make homemade meals and take coffee from home in a travel mug. Homemade meals will not only save money but are healthier as well.

- Try a 30-day no-spend challenge.

No Spend Challenge

Challenge yourself to avoid spending money for one month and use this money challenge chart to keep track of your progress. Decide ahead of time what you will purchase during your spend-free month. These exceptions should be things that you can’t and shouldn’t go without and they can include things such as food and gas. At the end of the month, you might have an emergency fund or be able to pay off some debt.

If you are required by law to submit expense reports (such as small business owners) then you should check with an accountant to find out which details you are required to include in your report. You might prefer to use accounting software or a business expense tracker app so that you can upload receipts if you are required to submit them.

About Me

I have an MBA in finance and I love creating templates to compare my budgeted expenses to my actual expenses. This helps me to stick to a monthly budget and reach my savings goals. I have created many budget templates for friends and family over the last 20 years and I am thrilled to share them with you here. If there are any more budget templates you would like to see on this site, then please leave a comment below.

I am obsessed with numbers, budgets and money-saving strategies. I love helping people avoid debt, pay off loans, save and reach their financial goals. I beleive that saving money is the key to reaching your financial goals, gaining financial security, and enjoying your life.

I am obsessed with numbers, budgets and money-saving strategies. I love helping people avoid debt, pay off loans, save and reach their financial goals. I beleive that saving money is the key to reaching your financial goals, gaining financial security, and enjoying your life.

THANK YOU SO MUCH. SO MUCH. I LOVE YOU I WISH YOU ALL THE HAPINESS IN THE WORLD

thank you! this really saves me time!

I love how you broke it down into sections explaining ways to use each tracker.

One thing that would be helpful for me is one that is designed for multi-family households. Maybe an added column for who paid how much and for what? I don’t know why money doesn’t make more sense to me.