These free savings tracker templates will help you save more and reach your financial goals

On this page, you will find money-savings charts and money challenges to promote savings and help you reach financial freedom.

70% of Americans live from paycheck to paycheck. They don’t save or invest for the future. Instead, they think short-term, focusing on what they can buy and enjoy in the present. When they reach retirement age, they won’t have saved anything. Also, if they have any unplanned expenses, they have no emergency fund to deal with them.

If you want to avoid this fate, you need to start saving. Set up a savings account and start saving each month. With the help of compound interest, even small investments can grow into big amounts by the time you retire if you start early enough.

The following savings trackers will help encourage you to save and track your savings.

Savings Tracker Printable

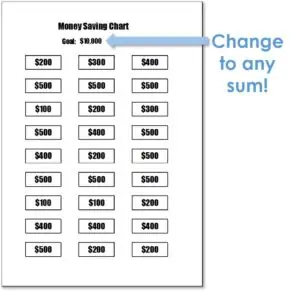

Money Saving Chart

Savings Jar Printable

This money-saving chart has a cute jar that shows exactly how much you have saved as a percentage of your savings goal.

Bullet Journal Savings Tracker

Free printable savings tracker bullet journal style. You can delete the dot grid background if you prefer.

Savings jar printable. In one jar draw the amount you want to save and move the amount you saved to the “Dollars saved”. Keep updating both jars.

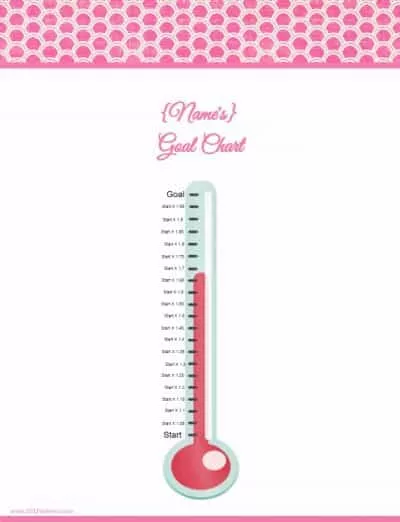

Savings Thermometer

Bullet Journal Savings Tracker

Savings Goal Tracker

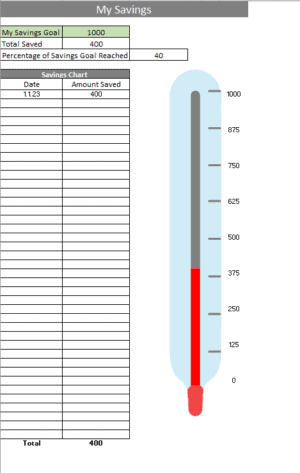

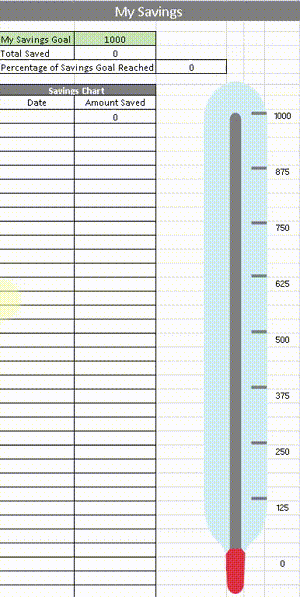

Image | Editable PDF | Excel Savings Spreadsheet

This is a blank savings goal chart. You can edit all fields but you cannot change the titles or add a border. To do that, select any of the printables below.

In the savings Excel template, there is a formula that will calculate how much you still need to save to reach your savings goal. Add your target savings goal and each week or month add how much you saved. The spreadsheet will automatically let you know how much you have saved in total and how much you still need to save to reach your goal.

52-Week Money Savings Challenge

We offer a free printable 52-week money challenge chart with many different variations.

There are different variations of this challenge. You can select the initial amount you save and weekly increments. One of the most common versions is to start saving $1 and then increase this amount by $1 each week. For example, the first week you will save $1, the second week $2, the third week $3, and the next week $4.

Saving Tracker Printables

You can customize the following free printable savings tracker before you print. Select any border or background or leave it blank. These will be great additions to your budget binder.

You can print the following printables with the same design you choose if you want a cohesive look:

- Expense Tracker

- Savings Tracker (see above)

- Budget Sheet

If you are just starting to save, why not try a 30-day no-spend challenge to jump-start your savings plan? Since our charts are editable, use can use any of the templates to make a money-saving challenge chart.

More Bullet Journal Savings Tracker Printables

In addition to the savings tracker bullet journal style above, there are more printable templates below.

This money-saving chart printable has four columns for the date, withdrawal amount, deposit, and balance. The titles can be edited if you want to change them.

Since the text is editable, instead of the notes section you can add your savings goal. The table has a column for the amount saved and one for the total saved.

Savings Excel Template

How Much Should You Save a Month?

Some financial experts recommend saving at least 10% of your income each month, whereas others say you should save at least 20% if not more. Senator Elizabeth Warren called this the 50/30/20 budget rule in her book, “All Your Worth: The Ultimate Lifetime Money Plan”. The 50/20/30 budget rule divides up net income (after-tax) and allocated it as follows:

- 50% on needs and obligations (such as rent, food, health care, car, etc)

- 30% on wants (things that are not essential such as vacations, entertainment, etc), and

- 20% on savings and investments.

This is, in addition, to your retirement plans.

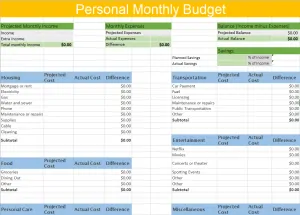

To check how much you are spending on needs and wants please see our expense trackers. To check how much income you have each month, please see our budget template printables.

Money Challenges

On the site, you will find various money saving challenges to help you save.

Even if you can’t afford to do any of these challenges then start small by saving your loose change. Put your coins somewhere you won’t be able to get them out. See the penny challenge.

If you need extra motivation to save, then try filling out a motivation template or creating a vision board. For example, if you are saving for a wedding then put pictures of your dream wedding. If you are saving to buy a home or new car then put pictures of homes or cars you love. The idea is to create inspiration to give you the motivation to prevent impulse shopping and save wherever you can.

Creating an Emergency Fund

It is very important to have an emergency fund to see you through to the next paycheck in case you are hit by an unexpected bill or expense.

Put the money you save in a piggy bank you cannot open or better yet in a high-yield savings account.

How big should your emergency fund be?

This really depends on your current financial situation. Ideally, your emergency fund should cover six months of living expenses. This sum should include rent, groceries, utilities, and all other basic living expenses. If this is out of your reach, aim for a minimum of $1,000 per person. Ideally, you should keep your emergency fund in an easily accessible bank account with an APY of at least 1 percent. If your emergency fund is tied up in investments it might not be available if suddenly required. Use the savings trackers above to create your emergency fund.

About Me

I have an MBA in finance and I love creating templates to help me save and create an emergency fund. I have created many budget templates and trackers for friends and family over the last 20 years and I am thrilled to share them with you here. If there are any more budget templates you would like to see on this site, then please leave a comment below.

My name is

My name is

I actually want to start saving some money and found a video about this…